Financial Independence Retire Early (FIRE): What Is It All About?

When searching for personal finance information, you have likely come across the FIRE movement which stands for Financial Independence Retire early. Before diving into the specifics of the movement and how you can incorporate the learnings into your personal finance strategy, let’s quickly summarize this movement. FIRE is the lifestyle choice of living well below your means so you can aggressively invest savings which can allow for retirement in your 30’s to 40’s instead of the traditional age of 65.

Seems quite straight forward, so who is the FIRE movement designed for?

The FIRE movement is for those who want to retire extremely early. So early that implementing this personal finance strategy often comes at some steep costs including extreme frugality and a minimalistic lifestyle after retirement. This idea of delaying frugality is not appealing to everyone – however, I encourage you to continue reading as the core principles explained below can be implemented to a lesser degree which can help anyone retire earlier!

Key Takeaways

- The FIRE movement encourages you to save and invest 50-75% of your income.

- Expense reduction is a key factor in being able to invest most of your income.

- Fire is determined to be achieved when you have 25-30 times your annual expenses saved. At this point many will retire and withdraw 4% or less per year to live off.

Many FIRE communities teach people financial literacy skills that enable them to set up a comprehensive plan that will enable them to achieve their retirement goals. In writing down your retirement goals, you can better understand what level of investing strategy is needed to achieve your goals. Once in retirement, those who practice FIRE will usually withdraw 3% to 4% of their savings annually which allows for them to maintain their version of a desirable lifestyle. Since the total amount needed to retire largely depends on the lifestyle those want to maintain in retirement there are a few different terms that are used within the FIRE community to quickly identify what lifestyle someone in the FIRE movement is trying to achieve.

The main popular categories of FIRE

- Fat FIRE – for individuals who want to maintain a high quality of living in retirement

- Lean FIRE – a retirement lifestyle that is very minimalistic

- Barista FIRE – a combination of part-time work and savings to fund their lifestyle

Although there are varying levels of retirement categories described above, the core principles are largely the same at each level.

Detailed Planning

This step is all about creating a detailed plan for your retirement and sticking with it. You should determine what quality of life you want to have in your retirement and what annual income will allow you to support that quality of life. This is the step where you will determine which category -- fat FIRE, lean Fire or Barista Fire you will follow. Once you have determined the category you will strive to retire in, with your annual expenses defined, you will be able to determine what total income you need to retire. This will allow you to properly set aside enough money and track if you are on progress to achieving your FIRE goal.

Economic Discipline

This is all about maximizing your income while minimizing your expenses. To maximize your income, continue to acquire valuable skills, this will allow you to get promoted which will help increase the total income you make. Those who make high salaries will find it easier to live on a smaller portion of their income which will allow for more money to be invested. The other strategy for good economic discipline is living well within your means. The less your living expenses total, the more money you will have which can be invested. This will allow you to meet the goals outlined in your detailed plan.

Wise Investment

This principle is all about setting aside a part of your income on a scheduled basis to help ensure financial independence in later years. Once you have the detailed plan determined from above, you need to stick with constant investing over the long-term to achieve your goals. Given that you are looking to retire early, or perhaps retire with a high quality of life, you will need to set aside more income than others. The earlier you can start doing this, the more you can take advantage of compounding interest, which will lead to better results. This will allow you to grow your investments to a point where you are financially stable as you become closer to FIRE.

When do you fire?

It is up to the individual and what they have planned out. Since many retire well before the traditional age of 65, savings that are approximately 30 times their yearly expenses are seen as a good base number. It is important to remember that there are risks associated with retiring early, such as poorly performing investments not providing you with enough to cover your basic expenses. This can cause you to use more principle than you have anticipated, which will continue to impact the amount you withdraw for the coming years.

Fat FIRE

Fat Fire is a category for individuals who want to maintain a high quality of living in retirement. This often involves their lifestyle remaining the same, which means that those engaging in fat fire need to have a larger amount saved, compared to the other categories of Fire. In some cases under fat fire, the individuals retirement becomes more lavish, as they draw amounts larger than they are used to each year. You may be asking yourself how this is possible? Usually in these scenarios individuals have been living within their means while building a profitable business or partnership that eventually gets sold. It is then upon receiving the large payout from selling the business that these individuals look to retire early. Many then seek advice on how they can fully utilize their large investment, while ensuring they are able to have enough to live throughout retirement.

Fat FIRE Example

For a different approach to a Fat Fire example, we will go over the scenario where someone sells their business for a large sum and walk through how they can set themselves up with the FIRE principle to retire with an increased lifestyle.

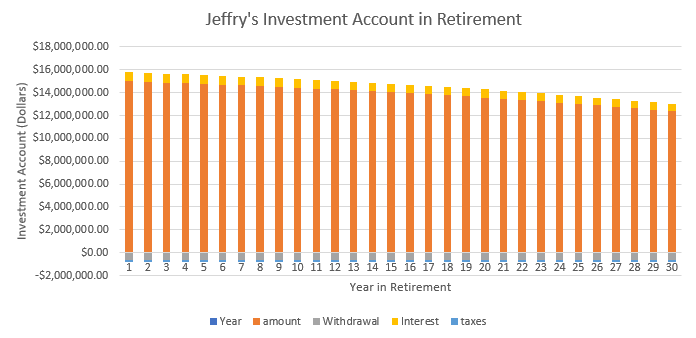

Jeffry started a construction business when he was 20 and has worked tirelessly to build it up over the past 25 years. Since much of the income the business makes is reinvested into growing, Jeffry pulled $75,000 annually to live off. This amount was enough to cover his expenses and live comfortably. However, Jeffery was unable to save for his retirement. He was recently approached by a large company within the construction space who became interest in Jeffry’s construction company to expand into the area Jeffery has a strong reputation with. When Jeffry was offered a very generous amount that would net him $15 million dollars after tax for his construction business, he decided to sell and is now looking to enjoy retirement. Jeffry would like to retire earlier and follow the FIRE principles to ensure that he has enough money throughout retirement.

Key Facts

- Jeffry is 45 years old

- He is currently living off $75,000 annually.

- He has $15,000,000 in his investment account from the sale of his business.

- Looking to live a lavish retirement.

If Jeffery were to comply with the conventional rule of saving 25-30 times his annual expenses, which are currently $75,000, he would need to save a total of $1,875,000 to $2,250,000. At this level of savings, Jeffery would be able to withdraw between $75,000 and $90,000 per year at a 4% rate. This 4% would be the recommended percentage withdrawal for a 30-year retirement. Since Jeffery is only 45 years old, it is wise that he takes the expected term of his retirement into account to come up with an appropriate percentage. If we were to apply the 4% rule to the total value of his investment account, Jeffery would be able to withdraw a total of $600,000 each year. This is well beyond the current salary he was currently withdrawing from his business.

Lean FIRE

Lean Fire is a category for individuals who want to live a simple lifestyle after retirement. This often means those that partake in Lean FIRE to live on less than $50,000 a year. Reducing expenses to make this figure a livable number takes strong discipline and requires that individuals use this amount to cover their most basic needs. For some followers of Lean Fire, the thought of an early retirement is so attractive that they are willing to decrease their quality of life to make early retirement an attainable goal. Since the rule of 25 is used in determining the total amount to be saved to FIRE, individuals who can decrease their annual income are able to FIRE faster. Others look to make their income go further by moving to a part of the world where the annual lean fire income will easily cover their living expenses and allow them to live comfortably.

Lean FIRE Example

For a nice example of someone participating in Lean Fire, we will look at a scenario where early retirement is very attractive to the individual and they are willing to live off of a reduced income to make it a reality faster.

Jacob currently works as a software developer and has been in the role for 5 years. His workload has increased throughout the years as he takes on more responsibility and he is feeling the stress. As a result, he has lost the passion he once had for developing software and now sees it as a means to an end. Jacob is currently 25 years old and would like to retire when he is 40 years old. Since he previously saw himself working until a very old age, Jacob has not started to set aside money for his retirement yet. Instead, he has spent his full income each year he has worked into increasing his standard of living. Given Jacob’s position and responsibilities within his company, he currently makes $125,000 a year after deducting taxes. Jacob has decided that he is able to live off $50,000 a year to increase the amount he is able to save for his retirement. He has made the decision that this amount will also be what he will live off when he has retired at the age of 40. Since Jacob is risk averse and would like to ensure that his investments are consistently growing, he decides to invest in a combination of debt and equity which will provide him a return of 5% each year. For the purpose of investment income, we will use a marginal tax rate of 30%. Jacob wants to know if his plan is possible if he contributes his excess income to his retirement savings account.

Key Facts

- Jacob is 25 years old.

- He is currently living off $135,000 annually.

- His living expenses will be $50,000 annually.

- Looking to retire by age 40.

- Return on investment of 5%

We are going to start with the basics of Lean Fire which state that Jacob should aim to save between 25-30 times of his annual expenses. Since Jacob has decided he is willing to live off $50,000 a year to make his early retirement a possibility, he should aim to have 25-30 times this amount in his investment account by the time he is 40 years old. This means that his investment account should be $1,250,000 on the low end and $1,500,000 on the high end when he reaches the age of 40. Jacob has a high salary that will allow him to fund his retirement faster. He makes $125,000 after taxes, which leaves him with $75,000 a year to invest into his retirement account after he pays for his living expenses of $50,000 a year. Over the period of 15 years, Jacob will contribute a total of $1,125,000 through direct contributions each year. When considering the interest that his investments will generate each year at a 5% return, as well as paying taxes at a marginal rate of 30%, Jacob will see his investment account increase by an additional $322,176. The total value of Jacobs investment account at age 40 will be $1,447,176. This investment account value is closer to the high end of the 25-30 times his required annual income amount of $50,000. At this value, if Jacob wants to follow the 4% rule, he will be able to withdraw $57,887.04 in the first year of retirement. He can then adjust this number for inflation in future years. Overall, if Jacob decides to follow this strategy, he will be able to attain his goal by the time he is 40 years old.

Barista FIRE

Barista Fire is the third popular variation of the FIRE movement in which individuals looks to retire early but keep working part time or at a lower stress job to supplement their income. Since this strategy includes continuing to work, it is up to the individual to find the correct balance for them. It is important to note that Barista FIRE means that the individual will continue to work continually for the rest of their life at this reduced rate. However, many countries have income assistance for residents over a certain age which can help to replace the income that was earned in the job taken as apart of the Barista FIRE plan. There is also another category of FIRE like Barista FIRE called Coast FIRE. The difference is that with Coast Fire, you only plan on having reduced working hours or a lower stress job for a period of time before fully retiring. This is often viewed as a better strategy as work can be hard when you reach a later stage in life. Coast FIRE allows you to ensure that your financial freedom is secure after a certain age.

Barista FIRE Example

For a example of someone looking to partake in Barista Fire, we will look at a scenario where an individual wants to retire earlier than the conventional age of 65 and is willing to partake in work after retirement to supplement their income from investments.

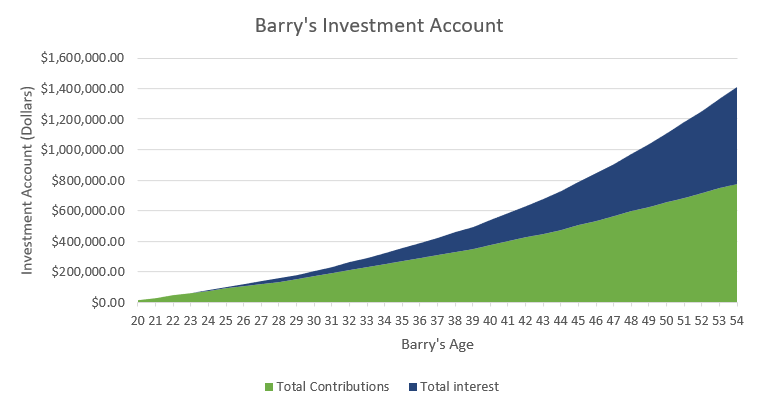

Barry is 54 years old and has worked as a carpenter since he was 20 years old. He has always lived well within his means and has consistently put money aside for his retirement as his income has increased with his years of experience. His income has been growing at a rate of 5% annually since he started contributing at the age of 20 years old. Barry expects that his tax rate will be approximately 25% if he retires. His investment account currently sits at $1,410,000. As the physical work of his job starts to wear on his body, he learns about the idea of Lean FIRE, where he can live off his investments in addition to supplementing his income with money earned from an established side business. He has calculated that he would like to have $75,000 of annual income to live comfortably. Since he is 54 years old, he is comfortable with having the 25-30 times annual income in his investment account to withdrawal at a 4% rate. His established side business is creating custom fishing lures for experienced fisherman who appreciate the increased quality his product has to offer. Since his fishing lure business is well know and has been used to catch some record-breaking fish, he has trouble keeping up with demand and is able to sell all the lures he makes. This side business currently generates him $15,000 a year, but he is confident that he can increase this to $25,000 a year once he has more time to spend on making lures.

Key Facts

- Barry is 54 years old

- He currently lives off $75,000 annually

- He is wondering if he can retire at the age of 54

- His side business can be expected to generate $25,000 a year

- Barry’s investment account is at $1,410,000

- Tax rate of 25%

For figuring out if Barry can retire, we want to see what level of income his current investment account will support at a withdrawal rate of 4%. Since Barry has been consistently investing for the past 35 years, his investment account sits at $1,410,000 which will provide him with income of $56,400 during the first year of retirement. This income alone is not enough to reach Barry’s goal of having at least $75,000 of income annually once he retires. Compared to his goal of $75,000 annual income, the income from his investment account of $56,400 is $18,600 short of achieving his goal. We will now take a look at his income earned from his fishing lure business to see if that will enable Barry to achieve his goal. The fishing lure business is expected to make $25,000 once Barry retires. After taking off taxes of 25% Barry is left with income of $18,750 from his fishing lure business. If we add the income from his investment account to the income from his fishing lure business, Barry will have income of $75,150 in his first year of retirement. This means that Barry is able to retire if he pleases, as his ability to generate income from his side business during retirement has allowed him to supplement his income to achieve his goal.