Check out this updated article for how much income is needed to afford a home in Canada.

The benchmark house price in Canada is $707,800 in January 2024 for the “typical” house. If you wanted to purchase a home at the average benchmark price, it would require a minimum $45,780 downpayment – which would leave a mortgage of $662,020. Monthly mortgage payments for this house would total $4,082.40 at a mortgage rate of 5.61% over a 25-year amortization period. Since it is recommended that a mortgage payment not exceed 32% of your gross annual income. You can also use a mortgage affordability calculator to help you determine the affordability on a home. This house would require you to have a salary of at least $153,127.66.

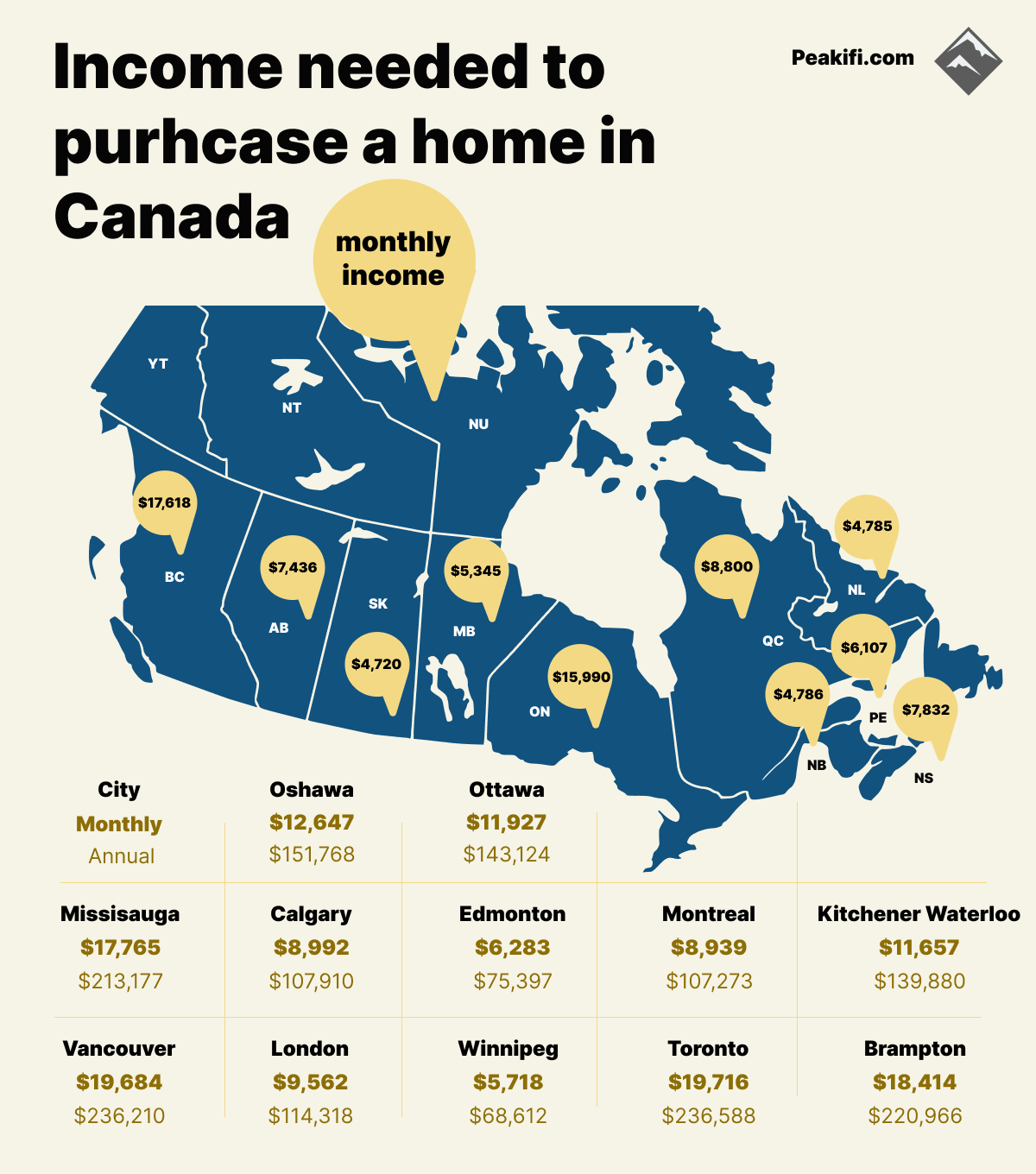

How much salary is needed to afford a house in each province and major cities

These salaries are based on making the minimum downpayment on a house with a fixed mortgage rate of 5.61% and a 25-year amortization period without the cost exceeding 32% of your pre-tax income. The house prices in each province and major city are based on the composite index which provides the average cost of a “typical” home in the area for January 2024.

Provinces that require the largest household income to afford a typical house are British Columbia and Ontario. The household income (HHI) required in BC to purchase the typical house is 211,416$ compared to HHI of $191,880 to purchase the typical house in Ontario. New Brunswick and Newfoundland and Labrador have the lowest household income required at $57,432 and $57,420 to afford the typical home.

Looking at the major cities in Ontario and British Columbia, we can see that the composite benchmark price in January 2024 for both Toronto and Vancouver can help explain why these provinces have such a high composite benchmark. To afford the typical home in Vancouver, you would need an annual household income of $236,210 compared to a household income of $236,588 to afford the typical home in Toronto.

Factors that impact salary needed for a home purchase

Several factors impact the total cost of purchasing a house in Canada — which will directly impact the household income needed to purchase a house.

Home Price

The first major factor that impacts the cost of purchasing a home in Canada is the home price – you can use benchmark prices as a way to determine the cost of a “typical” house in your desired area over time. Home price is also influenced by the type of home that you are looking to purchase. Popular home types in Canada include single-detached, semi-detached, row houses, and apartments – all of which will have different benchmark averages for the price of the home within each category. One of the most influential factors that impact a home price is the location of the property. For example, homes in populated major cities or desirable neighborhoods will affect the value of the home.

Mortgage Rates

Mortgage rates are another important factor included in the cost of purchasing a home in Canada. High mortgage rates can limit your access to funds needed to purchase a home. The reverse is also true for low mortgage rates which provide you with access to capital needed to purchase a home. If you needed a $750K mortgage to purchase a home, the difference between a 4% and 8% fixed mortgage rate would add up to paying an additional $300K+ of interest over the 25-year amortization period. If you want to further understand the relationship between mortgage rates and payments – you can check out our article on how mortgage rates impact your mortgage payments.

Down payment

The size of the down payment on a home will impact the salary needed to purchase a home in Canada. Making a larger down payment on a home will result in an overall lower total required mortgage. Since it is largely the size of the mortgage that impacts how much house you can afford, saving for a larger down payment will lower the salary needed to purchase a house. Canada also has in place special regulations around the required down payment needed to purchase a home. If the purchase price of the home is $500,000 or less the minimum downpayment required is 5% of the purchase price. This percentage increases to 10% for the amount of the purchase when the price is between $500,000 and $999,999. However, for any home that is $1 million or more, 20% of the purchase price is required to be provided for the downpayment on the house.

Stress Test

Since financial institutions want to ensure that you will continue making payments on your mortgage you will need to meet the requirements of the stress test. This test is a way to determine if you will be able to continue to make payments if either your mortgage rate increases (through rising interest rates) or your income decreases. This stress test will see if you can make payments on your mortgage by adding 2% to your contract rate or a rate of 5.25% – whichever is higher. Since the percentage used in the stress test increases when your contract mortgage rates increase, the total income that will be required to afford a home in Canada will also increase.

SC escape clause

The SC escape clause or sold conditional escape clause is a clause that allows the buyer or seller to back out of the agreement based on specific conditions. It is important to understand the meaning of sc escape caluse in real estate to make sure you don't lose out on a great home.