Mortgages: How Do They Work In Canada?

Looking to purchase a house in Canada? With houses being a significant expense, a mortgage is a financial product that you should fully understand and be familiar with to make the best financial decision. We will break down the different types of mortgages and the important components that vary to make up the many different mortgages available.

How does a mortgage work: the basics

A mortgage is a loan that can be acquired from financial institutions or private lenders that allows for the purchase of a home. This loan will need to be paid back to the lender based on the agreed upon terms. These terms are where the complexity of the mortgage lies and what we will be focusing on today. The type and terms of the loan will determine what kind of mortgage you can afford and determine your eligibility.

Types of mortgages

There are two options available when looking at loans which are fixed-rate and variable-rate. The difference in these loans has to do with the rate that is used to calculate interest on the loan.

Fixed rate loans have a determined price that is used to calculate interest on the loan. This makes the payments predictable which is a great way to ensure that you are able to afford you loan if market interest rates were to increase. In Canada the interest on all fixed-rate mortgages is compounded semiannually, which provides an advantage to the purchaser of the loan as they are paying down more of the principle with each payment.

Variable-rate mortgages incorporate the market interest rate into the interest calculation. This also introduces variability in the payments that are required to be made on the loan – as these payments differ with changes in the market interest rate. When the market rate increases, so will the required size of the loan payment. However, when the market rate goes down savings in the size of the required loan payment will be recognized.

Interest rates

The interest rates that are charged on mortgages impact not only the cost of borrowing but the size of mortgage that you are eligible for. Low interest rates provide borrowers with a cheap cost of debt which enables them to borrow more. The interest rate charged on mortgages is influenced by the interest rate provided from the Bank of Canada known as the prime rate.

Closed and open mortgages

When getting a mortgage you also have two options that impact your ability to make payments beyond what was originally negotiated in your payment terms. These two options are known as closed or open mortgages.

A closed-term mortgage is the most common type of mortgage that is used to finance the purchase of a house. A closed-term mortgage clearly defines the payment terms that need to be followed with deviation resulting in penalties applied. For example, trying to pay down your mortgage faster than outlined in the terms will result in penalties. This makes the payments the lender receives very predictable, in return the borrower receives access to lower interest rates.

The other mortgage would be an open-term mortgage. An open-term mortgage provides the borrower with the flexibility to repay the loan faster than originally set out in the terms without incurring any fees. This strategy can allow the borrower to pay off their mortgage faster which results in less total interest paid to the lender. Since this mortgage option introduces the ability to pay less overall interest by paying down the principal of the loan faster, the borrower will incur a cost for this flexibility in the form of higher interest rates.

Amortization period

The amortization period refers to the length of time in which the loan must be paid back to the lender. The typical amortization period in Canada is 25-years with some lenders offering 30-year amortization periods. Since the amortization period outlines the total length of the loan, longer periods will result in lower payments made over a longer period. It is important to consider that the longer an amortization period, which all else remaining the same, the more total interest that will be paid.

Mortgage term

The mortgage term refers to the period of time that your mortgage contract lasts with the lender. The most common mortgage term in Canada is a five years. Once this contract comes to completion, a new contract will need to be negotiated with the bank. This exposes you to determining a new contract at whatever the current market rates are. Mortgage contracts can be negotiated with a longer term, but will come at an increased cost of locking in the rate for an extended period of time.

Payment frequency

When entering into a mortgage contract, you will have to select from multiple payment frequency options. These options determine both how much you will pay and how often. There are options for accelerated payments which include additional payments allowing you to pay off your mortgage faster.

- Monthly: payment happen once a month

- Bi-weekly: take your monthly payment, multiply it by 12 and divide it by 26

- Weekly: take your monthly payment, multiply it by 12 and divide it by 52

- Accelerated bi-weekly: take your monthly payment, divide it by 2 and pay this amount every 2-weeks

- Accelerated weekly: take your monthly payment, divide it by 4 and pay this amount each week

How to determine eligibility for a mortgage

There are three basics that lenders use to determine mortgage eligibility. The better you are able to satisfy the below requirements the more favorable terms that will be extended to you.

- Good credit score – this helps show lenders that you are able to make your payments in a timely manner

- Minimum Downpayment – the minimum down payment required in Canada is 5% to qualify for a mortgage.

- Predictable Income – having a solid track record of stable employment with a consistent income

What kind of mortgage can I afford?

There are two main calculations that lenders use to determine the maximum mortgage that they will extend to you.

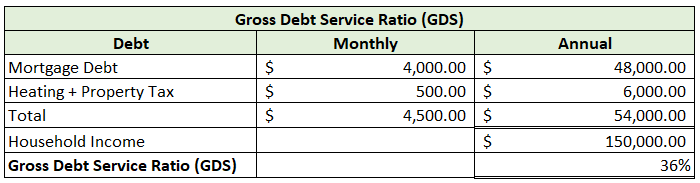

The first term is known as the Gross Debt Service (GDS) Ratio. This term measures your ability to pay the required housing costs that you will incur as a percentage of your pre-tax income. It can be calculated by adding up all your related housing costs, including the mortgage that would be extended to you and dividing it by your pre-tax income. The costs should not exceed 39% of your pre-tax income.

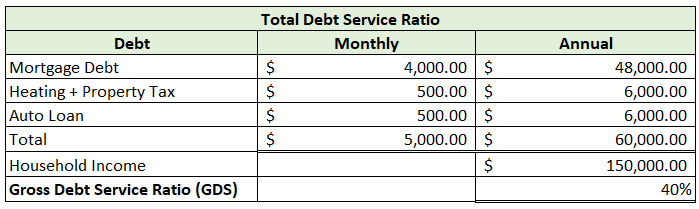

The second term used in the affordability calculation is the Total Debt Service (TDS) Ratio. This ratio looks to measure your ability to pay for all of your debts as a percentage of your pre-tax income. To calculate this ratio, you need to add all of your debt payments and divide that by your pre-tax income. Your TDS ratio should not exceed 44% of your pre-tax income.

Disclaimer: Mortgage Regulations and Requirements can change. It is essential to seek professional advice when making financial decisions around Mortgages. The percentages that lenders use in the calculation of TDS and GDS can also differ based on many other factors. It is important to use actual numbers when you are in the process of determining the amount of a loan you are able to receive.

Gross Debt Service (GDS) and Total Debt Service (TDS) Example

Lets walk through an example of investigating the purchase of a house to calculate both the Gross Debt Service (GDS) and the Total Debt Service (TDS) raito to see if it is a house that would be considered affordable by the typical lender. We will take personal factors such as personal debt we currenlty have as well as the costs associated with payments related to the mortgage on a house and other expenses.

A family is looking to purchase their first house and wants to know if it is attainable based on the GDS and TDS ratios. The household purchasing the house will be able to contribute two incomes to the purchase of the house. The first income is $90,000 and the second income is $60,000. The household has current loan debt of $500 per month which is related to loans on the vehicles that they use to commute to their respective jobs. No other loans are outstanding for the household. The house that is in question of purchase is $750,000. It has been determined that the household would like to make a 20% deposit on the purchase of the house and secure a loan for the remaining amount outstanding. The current market interest rate at which mortgages are lent out at is 6.49%. It has also been calculated that other expenses such as property tax and heating for the house will total an additional $500 per month. The household would like to know if this is a house that lenders are likely to provide them with the loan needed to fund the purchase of the house?

Key Facts

- Household incomes of $90,000 and $60,000

- Outstanding monthly loan payments of $500

- Purchase price of home $750,000

- Market interest rate on loan 6.49%

- Property tax and heating for the house is expected $500/month

- Deposit of 20% will be made on the house

To caluclate both the Gross Debt Service (GDS) and Total Debt Service (TDS) ratios, we need to determine the total household income as this will be used as the denominator in both calculations. Since there are two incomes of $90,000 and $60,000 we can add these together to get our total household income of $150,000.

lets start by calculating the Gross Debt Service (GDS) ratio. To be considered affordable when dividing the household income by the annual expense related to the house, the GDS percentage should not exceed 39%. The expenses that relate directly to the house are the cost related to the expected property tax and heating which are estimated at $500/month. Multiplying the monthly cost by 12, we can see the cost of property tax and heating are expected to be $6,000 annually. To find the mortgage payment, we need to start by calculating the mortgage amount the couple will need. Since the cost of the house is $750,000 and the couple is looking to put down 20% as a down payment, they will contribute a total of $150,000 initially. This leaves a remaining $600,000 that will need to be acquired in the form of a loan. By using a reputable mortgage estimation tool by the bank at an interest rate of 6.49% we can see the estimated monthly payment is approximately $4,000. This means that the total cost of the mortgage of the course of the year will be $48,000 when multiplying the monthly payment by 12. The last step in the calculation is adding all of the annual expenses and dividing by the annual household income. This gives us $54,000 of total yearly expenses related to the cost of the house divided by the $150,000 annual household income for a GDS ratio of 36%. Since this is below the target of 39% this household is seen as being able to service their debt related to the purchase of this house.

Next we will calculate the Total Debt Service Ratio (TDS). This ratio should not exceed 44% for it to be considered that the household will be able to make payments on all of their outsanding debts. It is quite possible to have a good Gross Debt Service Ratio but not a Total Debt Service Ratio depending on what additional loans you have that are not directly related to the house being purchased. In the case of this example, the household has additional debts of $500/month which relate to loans that they have taken out on their vehicles used as transport to their jobs. The annual amount required to service this additional loan is $6,000. We will add this to the numerator of our previous calculation to caluclate the Total Debt Service (TDS) ratio. This means that expenses related to debt in the year total $60,000 which when divided by the household income of $150,000 gives us a TDS of 40%. Since this ratio should not exceed 44%, this household is seen to be able to service their debt service ratios.